How Your Credit Score Impacts Your Financial Life

It’s been said, if you don’t own a home, your most valuable asset is your credit score.

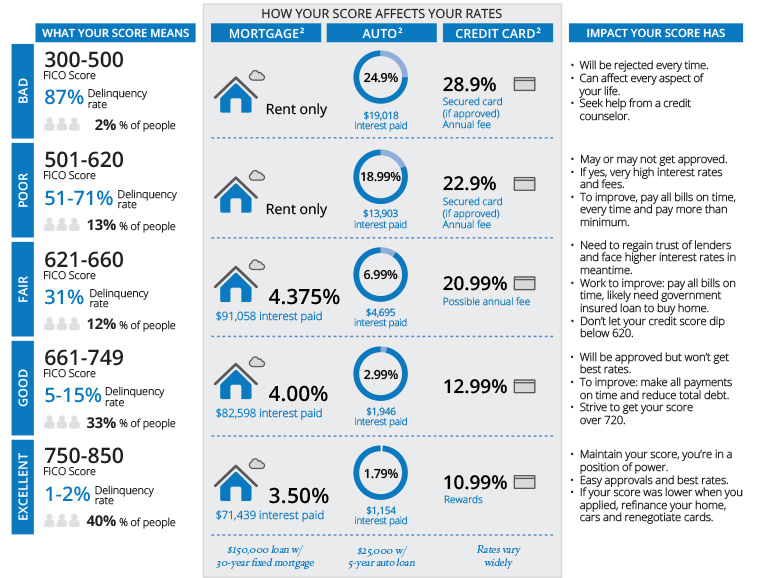

Of all the ways to save money, improving your credit score can save you a small (or large) fortune over your lifetime. Simply because good credit allows you to secure lower interest rates, gain longer term loans, make smaller down payments and gain credit card rewards, the money you’ll save in interest is worth making sure your credit reports are spic and span.

In fact, a good credit score might even be more important to your financial health than a college degree. Your score not only affects your ability to buy a house, a car or obtain credit cards, it is also used by a landlord in qualifying you as a potential renter, setting your insurance premiums and can be a factor in your getting hired.

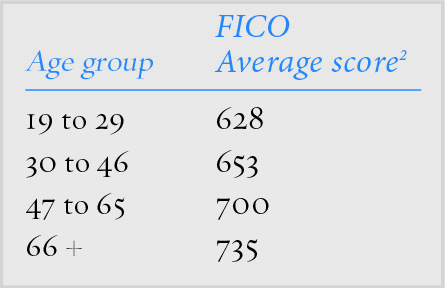

The average Michigander’s FICO credit score is 6881. Generally the older you are, the higher your credit score is – so there is one win for age before beauty, although younger people have lower credit scores mainly due to lack of information versus credit mistakes.

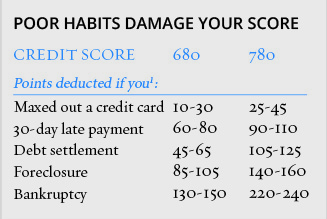

Once you know your score, you also need to be aware how much financial mishaps could cost you:

When you apply for credit, lenders will often disclose your score at no cost. Some credit cards now provide your credit score on your statement or online. If you are denied credit, you are given a credit report and score. You can also purchase your score for about $20 online.

1 MyFico.com, Governing.com

2 Credit.org

3 Advanced Credit Scoring, Dave Sullivan

4 First State Bank Loan Department, August 2016